The unfolding bi-polar global economy emerged this week with talk of “green shoots” in the US being mimicked by “bamboo shoots” in China. Several leading indicators from stocks, housing and credit markets had some hoping that these were early signs of recovery. This was then dashed with reports of poorer than expected retail spending in the US and weaker GDP growth in China later in the week. Closer inspection of China's data however show that there were genuine signs of recovery burried in the figures.

The Economist rightly points out that the slowdown in China is a result of purposeful policy back in 2007 when authorities were worried of overheating and restricted the flow of credit. The recent data shows that lending and investments have been restored, and that consumer spending has remained robust (read Jim O'Neill from Goldman Sachs referring to China as the new shopping superpower here). What has been impeding growth overall is the slowdown in exports resulting from weak demand from abroad. Contrary to perception though, employment in the tradable sectors accounts for only 10% of the labour force and much of the content of their exports is imported from abroad (only about 18% is locally value added, which translates to 7.2% of GDP).

Andrew Peaple of Dow Jones writes in the Wall Street Journal that:

the debate among economists is becoming more alphabetical. Is this recovery V-shaped, with China set to return quickly to the high-level growth of recent years? Or is it more W-shaped, as a government spending-led recovery this year peters out and China's longer term structural issues resurface?

Manoj Pradhan of Morgan Stanley forecasts that:

(G)lobal output will probably start growing in 3Q09 (3rd quarter of 2009), with G10 output growth turning positive in 4Q (4th quarter). However, growth for 2009 as a whole will stay firmly in negative territory for all regions except AXJ (Asia excluding Japan) ... We expect AXJ’s outperformance to be sustained next year with a 6.4% increase in output, compared to 2.1% for CEEMEA (Central and Eastern Europe and Middle East and Africa), 1.1% for the G10 and 0.3% for Latam (Latin America).

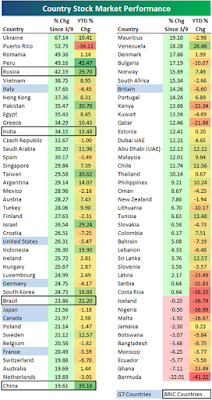

That developing Asia will lead the world to recovery is evident from this forecast as well as by consulting this year-to-date chart of stock market performance around the world assembled by Bespoke Investments. Apparently, there could still be something to the BRICs and decoupling argument after all.

The Impact of China's Stimulus

Markets cheered when the leaders of the G20 emerged from their summit in London with little more than an agreement to infuse the IMF with additional capital through issuing SDRs (special drawing rights) intended for distribution among member countries. Dani Rodrik points out the significance of these measures.

To produce greater bang for each buck from a fiscal stimulus plan, countries have to increase their Keynesian multiplier. One of the things that reduces the multiplier effect is the marginal propensity to import. To prevent leakage of such spending on foreign goods (the effect of the marginal propensity to import), it is essential for other countries to "pull their weight" and engage in similar levels of spending. In developing markets, credit and liquidity was drying up, limiting their capacity for fiscal spending .

This is why the Chinese fiscal stimulus which is roughly equivalent to 90% of Australia's entire GDP was significant for advanced economies. Some estimates put the multiplier in China at 1.1, meaning $1 spent by the government leads to $1.1 of additional spending elsewhere. Picture the output of Australia for two years being disbursed in less than a year. Much of this multiplier is due to the public investment nature of the spending on roads and basic infrastructure. For this reason, resource rich countries like Australia will have much to cheer about in the coming months.